When Markets are Jumpy, Maintain Focus on Your Goals

After enjoying a bull market, it’s easy to forget that volatility includes stock prices going down as well as up—and that such movement is practically guaranteed.

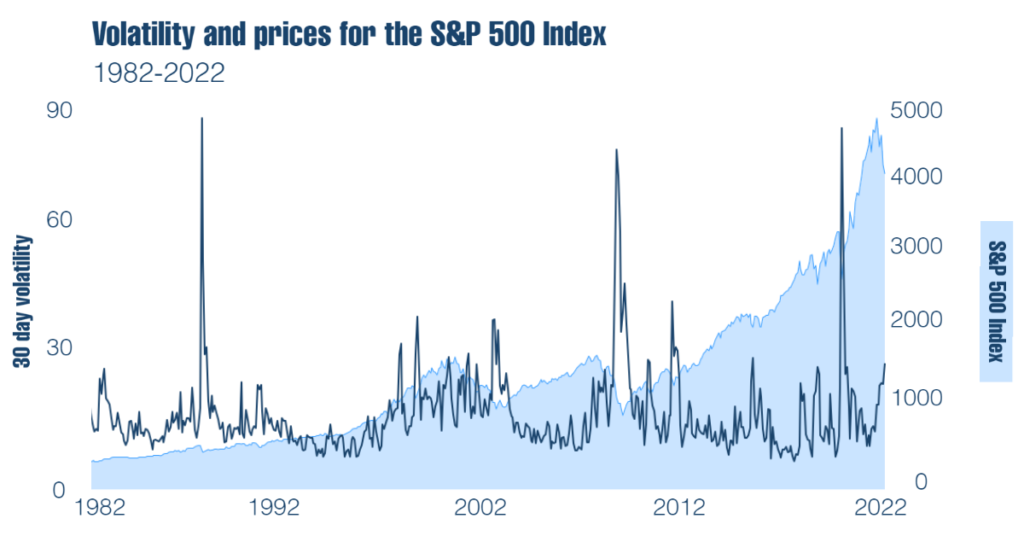

While you can’t control the markets, you can manage how you react to their swings. The key is to zoom out from any particular period and focus on the long-term trend. As you can see in the chart below, the Standard & Poor’s 500 Index, widely used as a proxy for the U.S. stock market, has been one long succession of volatile periods. However, despite the historical volatility, the index increased nearly 19 times in value during the period shown. Investors who jumped ship during the volatile times, by selling their stock portfolios, would have missed out on the impressive gains that followed the declines.

Volatility can also create a great opportunity to rebalance your strategic asset allocation. Volatility in the market might make it possible for you to sell concentrated equity positions or high-cost active holdings with no tax penalty. Together, we can plan for such opportunities and take advantage of them when they appear.

Both of the considerations discussed here about volatility underscore the importance of determining your financial goals and working together on a plan to reach them. That plan serves as a financial North Star—a constant reminder that can guide you to the outcomes you want, independent of market conditions.

The opinions herein are those of Trust Point Inc, are made as of the date of this material, and are subject to change without notice. Trust Point uses its best efforts to compile its data from reliable sources, however, it does not warrant the accuracy, completeness or timeliness of any of the information provided. This publication is prepared for general information only. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Investors should seek advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. All investing involves the risk of loss, including principal, a reduction in earnings, and the loss of future earnings. Past performance is no guarantee of future results. Individual client portfolio positioning, performance and transactions therein can vary greatly based on factors including investment strategy, objective, limitations, risk tolerance, time horizon, asset composition, asset allocation and tax implications.