Roth vs Traditional Contributions

What Are They?

For years, individuals participating in a 401(k) could only contribute in a traditional fashion. It wasn’t until 2006 when many 401(k) plans adopted a Roth contribution feature. This was a game changer for many people and we will walk through those benefits. But first, let’s walk through the differences between Roth and traditional contributions.

How Are Roth and Traditional Contributions Different?

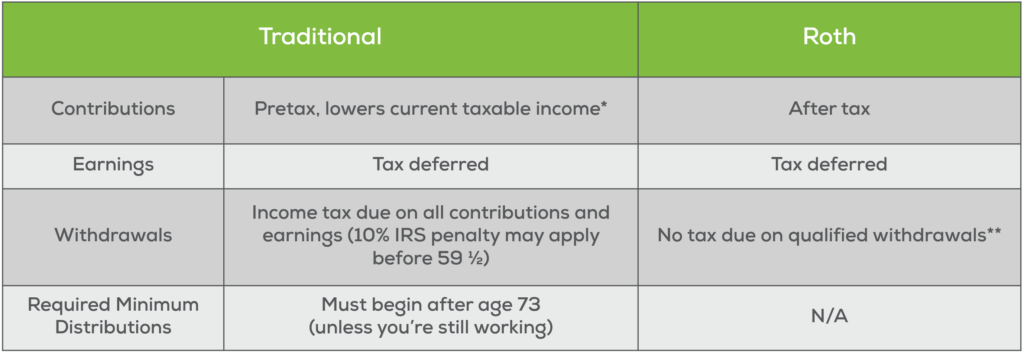

A traditional contribution into your 401(k) is tax-deferred which means you receive a tax deduction in the amount of your contribution. The earnings on those contributions are also tax-deferred. You pay taxes on the contributions and earnings when you take a distribution.

A Roth contribution into your 401(k) is after-tax which means you pay the tax up front. The earnings on those contributions are tax-deferred (just like earnings on a traditional contribution). However, qualified withdrawals are tax-free!

The table below illustrates how traditional and Roth contributions impact your paycheck. The slight tax savings traditional contributions provide result in retirement savings being taxable. Roth contributions receive no tax savings up front but result in retirement savings being non-taxable.

Roth vs. Traditional Contributions: Which Should I Choose?

If you expect your tax rate to be higher in retirement than it is now, Roth contributions could benefit you. Committing to pay the tax at a lower tax rate allows you to not pay taxes at your higher rate when you take qualified distributions.

If your tax rate is higher now than you expect it to be in retirement, traditional contributions may be the option for you. Delay paying the tax until retirement when you’re subject to a lower tax rate.

Can I Contribute to Both Roth and Traditional Contributions?

You can use multiple different retirement savings accounts at the same time, such as contributing to both Roth and traditional 401(k) accounts through your employer. However, the contribution limit applies to the total contributed between the two accounts each year. For example, the 2024 annual maximum contribution is $23,000, or $30,500 for those aged 50 and older. Please note that this limit does not include any matches by your employer, so those contributions count as a bonus on top of those limits.

Roth vs. Traditional Contributions: Other Things to Consider

- Do I want to avoid required minimum distributions?

- Do I plan on using my 401(k) in retirement?

- Possibility of higher tax rates through legislation in the future

Make sure to always consult with a tax professional to make the most impactful and tax-advantaged decisions for your retirement savings.

Wondering whether Roth or traditional contributions make the most sense for you? Set up a time to meet with our financial professionals to create a personalized retirement plan unique for your goals.