Pump Up the Savings

Concerned about your financial fitness? Worried that you’ve been neglecting your retirement plan? Saving more can help you get things into tip-top shape. If you haven’t increased the amount you contribute to your plan in a while (or ever), here’s why it’s a good idea to give your savings a boost.

Compounding Work Out

The earlier you increase how much you’re saving for retirement, the more time your money can potentially benefit from the power of compounding. Compounding begins when your retirement savings generate investment earnings. Those earnings are added to your plan balance and reinvested. Then you have the potential to earn a return on your contributions and your earnings. The longer this process has to repeat itself, the larger your account balance may be at retirement.

Built-in Benefits

A built-in benefit of your employer’s retirement plan is tax-deferred compounding. When your plan investment earnings are reinvested, no income taxes are taken out. So all of your money remains invested in your plan and potentially benefits from compounding. Over your career, tax-deferred compounding can have a significant impact on the amount of money you’re able to accumulate in your plan account. You’re not taxed on investment earnings until you withdraw money from the plan.*

More Reps, More Results

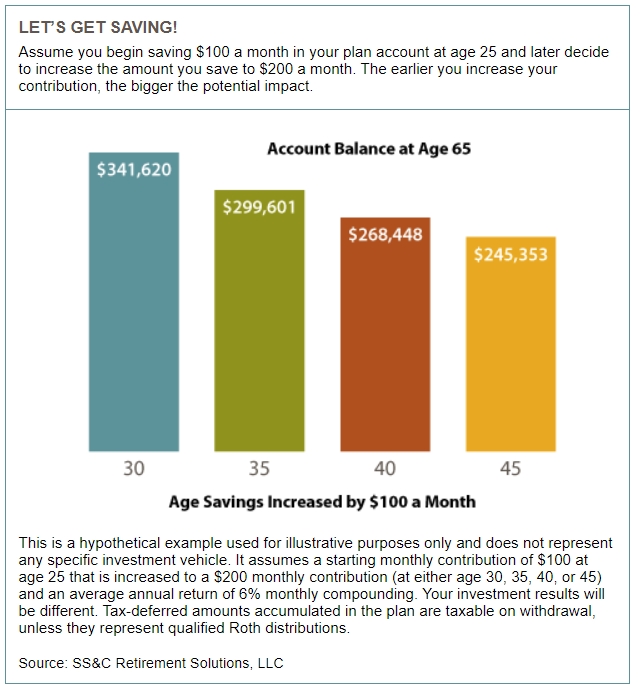

Increasing the amount you’re contributing to your plan may help boost the benefit you get from tax-deferred compounding. And the sooner you start saving more, the greater the potential impact.

Stick to Your Schedule

Saving consistently is a key to achieving financial fitness. Sticking with your contributions and increasing your contribution amount when possible can help you reach your retirement goals.

Your situation is unique, so be sure to consult a professional before taking action. Schedule a meeting with us if you’re ready to see how we can help.

*Distributions of tax-deferred amounts are subject to income taxes unless they consist of qualified distributions from a designated Roth account.