Built-in Tax Benefits

Potential tax advantages are one of the built-in benefits of your employer’s retirement savings plan. Just by participating in the plan, you have the opportunity to make pre-tax contributions, which may enable you to benefit from tax-deferred compounding. Plus, you might qualify to claim a tax credit for your contributions. These tax advantages, combined with your plan’s other great features, can help you achieve your retirement goals.

Pre-tax Contributions

The amount you contribute pretax is deducted from your pay before federal (and, possibly, state and local) income taxes are taken out. Contributing on a pretax basis reduces the amount of income taxes you currently pay on your earnings. You won’t owe federal income taxes on your pre-tax contributions until you receive distributions from your plan. Increasing the amount you contribute to your plan can further increase your tax savings.

Tax-deferred Compounding

Any income you earn from investing your contributions is also tax deferred. Compounding can occur if your plan contributions generate earnings and those earnings are added to your balance and reinvested. Over time, tax-deferred compounding can have a big impact on your account balance.

Roth Distributions

Note that if your plan offers a Roth contribution option, such contributions don’t provide immediate tax savings. You will be taxed on that money in the year you earn it. The potential tax benefit that the Roth option offers is that qualified Roth distributions aren’t subject to any federal income taxes if you meet certain tax law requirements.

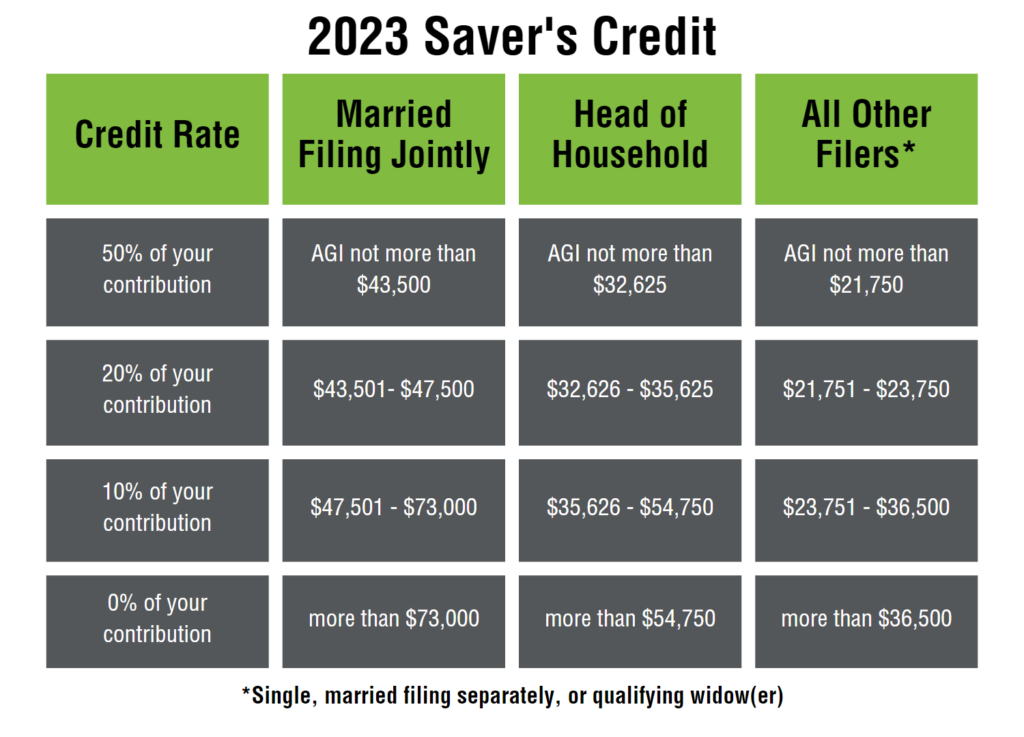

The Saver’s Credit

You may be eligible to claim the “saver’s credit” on your tax return for contributions to your employer’s retirement plan. Your income and tax-filing status determine whether you’ll qualify for this credit and your credit rate. If you do qualify, the credit is 10%, 20%, or 50% of your contributions up to $2,000 ($4,000 if married filing jointly). To claim the credit, you must be age 18 or over and not a full-time student, and you can’t be claimed as a dependent on another person’s return.

Your situation is unique, so be sure to consult a professional before taking action. Book an appointment with the Emerj360 team if you have questions.