What is a Financial Plan?

Life is busy, which is why you should always have a plan—especially when it comes to your finances. No matter what stage of life you are in, it is important that you have a financial plan to help you stay on track in how you are spending, saving and growing your wealth.

We often hear about the importance of financial planning, but many don’t know exactly what a financial plan consists of, or how to go about creating one. Below is an overview of what a financial plan is and the steps you can take to get started.

What is Financial Planning?

A financial plan is a comprehensive overview of your current finances, your future financial goals, and the steps you need to take to reach those goals. While enlisting the help of a financial professional is important in creating the best financial plan possible, your planning ultimately starts with you. Before creating a financial plan, you have to set goals—both short term and long term. Think of your financial plan as a roadmap that can help guide you to make decisions that align with your objectives.

Over time, your financial plan will evolve with life events. For example, if you get a new job, get married, have a child, or buy a new home, these milestones will impact almost all aspects of your financial plan. When this happens, it is important to consult your financial planner who can help you adjust it along the way.

Key Components of a Financial Plan

To create a financial plan, it’s important to understand the key elements that are a part of it. You want your financial plan to be as comprehensive and organized as possible so it is easy to consistently follow. These pieces can include your:

Budget

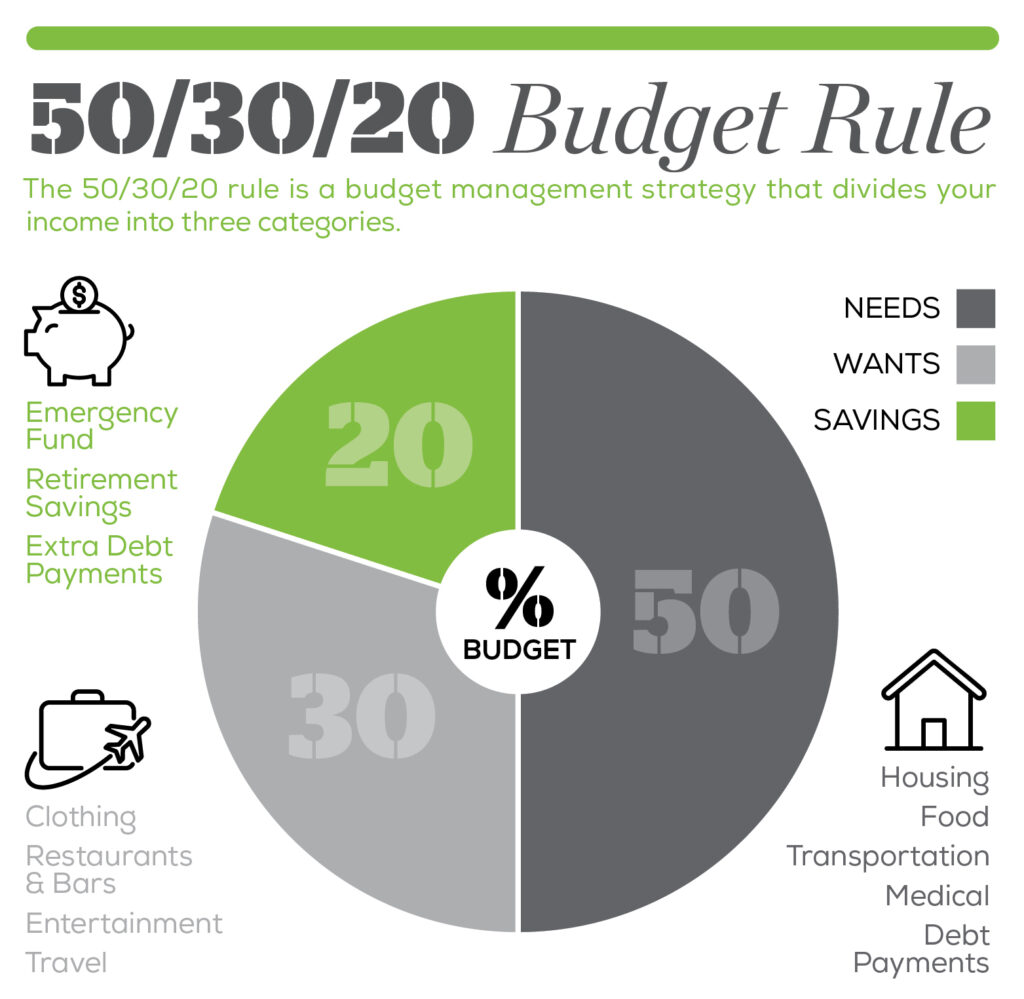

Your budget will indicate how much you can spend based on your income and expenses. One rule of thumb when creating a budget is the 50/30/20 rule—you spend 50% of your budget on needs, 30% on wants and 20% on savings.

This strategy will make it easier for you to stick to your plan and adjust your budget as needed.

Debt Management Plan

In order to reach your goals, you need to manage your debt. The sooner you pay off your debt, the sooner you can gain more financial flexibility and avoid higher interest rates and payments. Whether you choose to pay off your largest debt first or to pay off debt with the highest interest rate first, your financial plan should include a strategy for addressing your debt.

Investment Portfolio

Investing is essential for growing your wealth and building a successful financial plan. There are many investment types and strategies you can employ when making investment decisions, but ultimately, working with a financial professional can help you navigate strategies and important investment information.

Retirement Planning

Your financial plan should lay out the steps you need to take in order to retire, because no matter what stage of life you are in, you should be saving for retirement. There are many ways you can save for retirement, but contributing to an employer-sponsored retirement plan like a 401(k) is the easiest way to do this. It often allows you to take advantage of the tax benefits and employer matching that typically comes along with it.

Tax Management

When creating a financial plan, you should ask yourself questions like: Do I need to hire an accountant to do my taxes? Are there tax breaks I can take advantage of? How can I make paying my taxes easier? Tax law and policies can be confusing, but with the advice of a financial professional you can identify how you will go about paying your taxes in the coming year.

Estate Planning

Your estate plan contains the directions you have for how your property and assets will be passed down following your death. Estate planning can be complicated—both logistically and emotionally—but it is an important piece of your financial plan, especially as you get older. You can start by outlining your ideas of how you want to leave your estate, and work with a financial advisor to help you navigate the rest.

Getting Started

Understanding financial planning can be difficult, but Emerj360 can help. We offer a variety of online resources that can help you learn more about financial planning. You can get started today by setting up a meeting with an Emerj360 professional.

We will sit down with you to discuss your goals and develop a personalized plan for you. When you work with an Emerj360 professional, you’re working with a fiduciary, meaning you are receiving guidance in your best interest. We recommend that each year or following a major life event, you follow up with us so we can help you adjust your plan as necessary, and continue working toward your financial goals.