It’s Not a Windfall, It’s Your Savings

What happens to the money in your retirement plan account when you switch jobs? That’s up to you. Typically, one of your options may be to take your savings in a single sum. Sounds like a windfall, right? Wrong. Here’s why you should think long and hard about cashing out your retirement savings.

Less Money Now

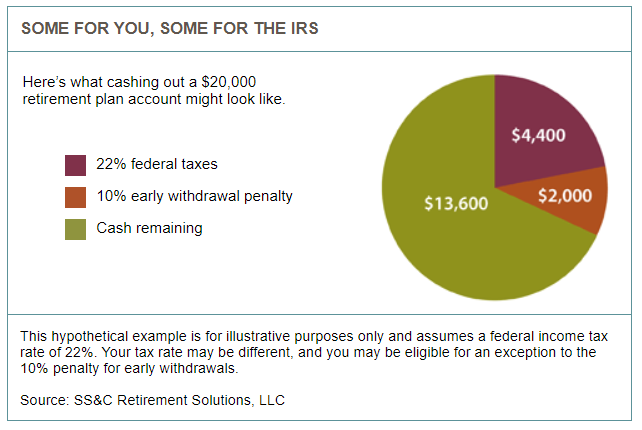

Before you drain your account, make sure you understand how a cash-out works. You may be in for some surprises. The first one is that you won’t get to keep the full amount. Since the money in your retirement savings account generally has not been taxed,* you’ll have to include the distribution in your income on your federal (and possibly state) income tax return.

Additional income means you’ll owe additional federal (and possibly state) income tax. The retirement plan is required to withhold 20% to send to the IRS as a “down payment” of sorts on your overall federal income tax liability for the year. And the final surprise: You may also owe a 10% early withdrawal penalty.**

Less Money Later, Too

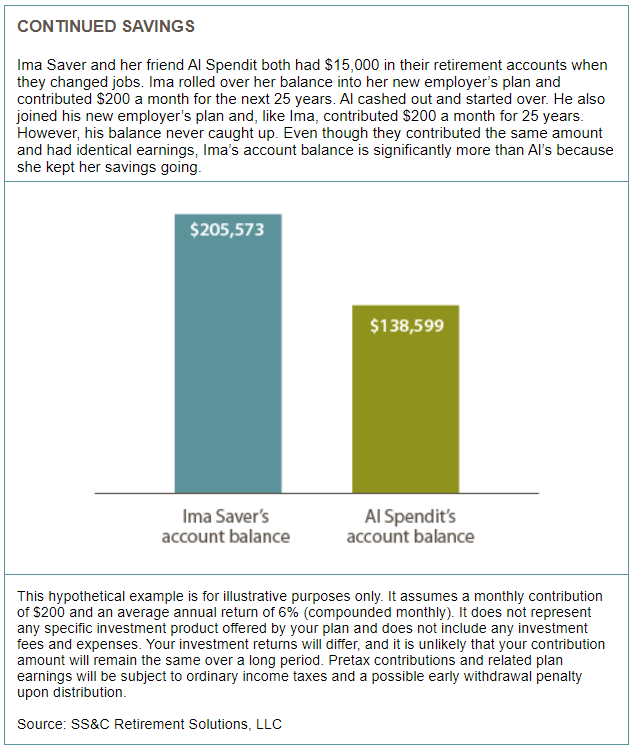

Not only will you get less when you cash out, but taking a distribution and not reinvesting the money for retirement could also mean you’ll end up with less in the future. Spending your savings now could shortchange your future. Will you be able to rebuild your account balance? Even if it’s still early in your career, taking a distribution, paying the taxes and any penalty that applies, and spending what’s left could make it harder to reach your retirement savings goals.

Keep It Growing

Instead of cashing out, consider keeping your savings in a tax-deferred account. Here are the possible options:

- Leave your savings in your old employer’s plan (if permitted)

- Roll over your money into your new employer’s plan (assuming rollovers are accepted)

- Roll over your money into an individual retirement account (IRA)

Rollover Rules

Generally, the simplest way to handle a rollover is to have your savings transferred directly from your plan to the new tax-deferred account with a trustee-to-trustee transfer. Since the distribution isn’t paid to you, no income taxes are due and no penalty applies.

Things can get complicated if you decide to take an eligible distribution and roll it over yourself. First, the rollover must be completed within 60 days. Second, the mandatory 20% income tax withholding applies. To complete the rollover, you’ll have to replace that 20% with money from another source. If you don’t replace it, the 20% is considered a taxable distribution (and the 10% penalty may apply).

Have additional questions on what to do with your 401(k) account when you switch jobs? Set up a meeting with a member of our team to discuss your options.

* Some retirement plans also offer a Roth contribution option. Unlike pretax contributions, Roth contributions do not offer immediate tax savings. However, qualified Roth distributions are not subject to federal income taxes when all requirements are met.

** The penalty is not deducted from the gross amount of the distribution but is payable when you file your tax return, unless you qualify for a penalty exception.