Controlling Risk When Investing Near Retirement

Managing investment risk takes on added importance for investors nearing retirement. Within a few years of retirement, you’ll want to pay close attention to the different types of investment risks you face and develop strategies for protecting the hard-earned money you’ve saved towards retirement.

How to Assess Your Risk Comfort Level

Risk tolerance is the ability and willingness to handle potential losses from an investment. You can gain a fairly good understanding of your comfort level for risk by answering these questions:

When will you need the money?

Early on in your working career, you have what’s called a long investing time horizon. And as a result, have a higher level of risk tolerance. If you have 30 years of work left, your ability to absorb market corrections is greater than if you had 5 years of work left. Why is that?

The closer you are to retirement means the closer you are to initiating distributions of your retirement assets. If the market corrects and your stock exposure is high, the impact on your years in retirement could be damaging.

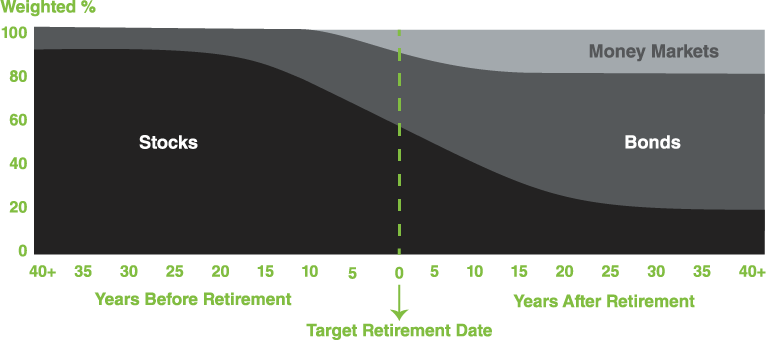

Below is a helpful visual that generally explains how your allocations should change from early in your working career to your years past retirement.

How honest are you about your capacity to handle loss?

Many investors overestimate their capacity to handle portfolio losses. A bear market is a market decline of 20% or more, and can sometimes take several months or years to recover the losses. Again, the closer you are to retirement, the more sensitive your retirement assets are to market declines. You simply don’t have as much time to allow markets to rebound appropriately.

Will a big loss have a big impact on your future plans?

Would a loss of 15% or 20% force you to postpone plans to move to a new location? Would such a loss mean that you couldn’t build that sunroom or redo your kitchen?

How to Manage Investment Risk

After answering these questions, you hopefully have a better understanding on how your allocations should change over time and near retirement.

Invest in a way that can help you reach financial security in retirement without sacrificing your emotional well-being.

Making investment decisions based on the number of working years you have left is key to successful retirement investing. If you’re nearing retirement and have a high stock exposure, adjusting your allocation could help absorb inevitable market declines, and as a result protect the hard-earned money you’ve saved towards retirement.

The investments at Emerj360 are managed by an experienced team. If you’d would like to have a conversation with one of our financial professionals, schedule a meeting with us.