Catch-Up Contributions

Saving enough money for a comfortable retirement is likely one of your primary financial goals. However, with so many demands on your finances, it’s easy to get off track. If you’re 50 or older and want to make up for lost time, tax laws allow you to ‘catch up’ on your retirement savings.

You can contribute extra amounts to an employer-sponsored retirement savings plan and/or an individual retirement account (IRA).

Save Through Your Employer

401(k) plans and other employer-sponsored retirement plans allow participating employees to contribute a portion of their pay to the plan.

In 2024 – if you are under the age of 50 – the most you can individually contribute into your employer-sponsored retirement plan is $23,000.

However, if you’re 50 or older, you can contribute an additional $7,500 to your employer-sponsored retirement plan as a “catch-up contribution.”

Save on Your Own

A similar opportunity exists with individual retirement accounts or IRAs.

In 2024, if you are under the age of 50, the most you can contribute to an IRA is $7,000.

However, if you’re 50 or older, you can contribute an additional $1,000 to your IRA as a “catch-up contribution.”

There is no rule against contributing to an employer’s plan and an IRA — you can do both!

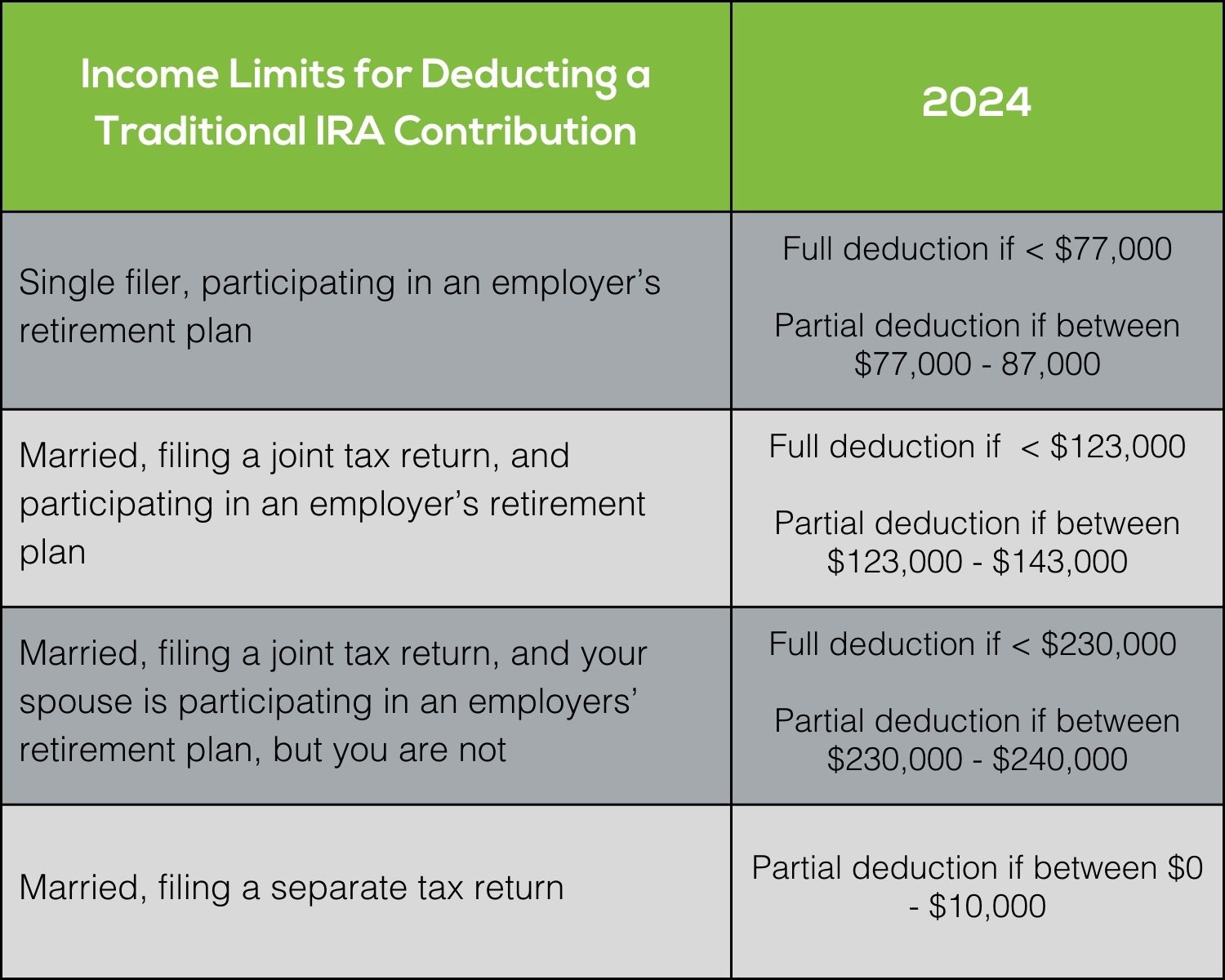

However, depending on your income, contributions to a traditional IRA may or may not be tax deductible when you or your spouse participate in an employer’s plan.

The annual limits on contributions will increase in the future. If you are able, taking advantage of catch-up contributions can be an impactful step in building up retirement assets.

Work with a Financial Professional

Looking for guidance to get back on track with your retirement savings goals? Schedule a meeting with a financial professional at Emerj360.