Am I Saving Enough for Retirement?

“Am I saving enough for retirement?” is a question on the minds of many people. Unfortunately, for many individuals, the answer is, “No.” But, we are here as your best financial friend to help along the way.

Believe it or not, the government offers tax benefits to retirement savers to encourage putting money aside for the future. One of the available tax-advantaged saving methods is the Roth IRA.

So what is a Roth IRA?

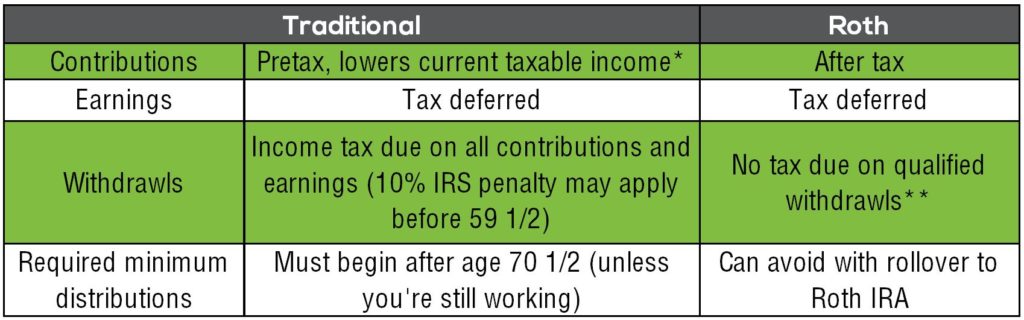

A Roth IRA is the opposite of a traditional IRA. A traditional IRA is often referred to as a pre-tax account while the Roth IRA is referred to as an after-tax account. Why is that?

With the traditional IRA, you may deduct annual contributions that ultimately lower your taxable income. This means you delay paying taxes on the monies you contribute. But, all withdrawals in the future are fully taxable.

With a Roth IRA, you receive no up-front deduction for annual contributions. This means you pay the tax on the monies before the contribution is made. But unlike the traditional IRA, all qualified withdrawals in the future are tax and penalty-free.

How do you become eligible for a Roth IRA?

Generally speaking, eligibility depends on your adjusted gross income, or AGI, and your tax filing status. As long as you make $146,000 or less as a single filer, or $230,000 or less filing jointly, you are able to contribute the full amount.

| 2024 ROTH IRA INCOME LIMITS | ||

| Single or Head of Household | Married Filing Jointly | |

| Full contribution with AGI* less than: |

$146,000 | $230,000 (joint) |

| The amount of the contribution phases out if AGI* is between: |

$146,000-160,999 | $230,000-$239,999 (joint) |

| No contribution is allowed if AGI* equals or exceeds: | $161,000 | $240,000 (joint) |

| * Refers to AGI with specified modifications | ||

How much can be contributed to a Roth IRA each year?

Eligible individuals under the age of 50 may contribute up to $7,000 while those over 50 may contribute up to $8,000. However, contributions to all of your personal IRAs for a tax year cannot exceed the contribution limit for that year. So, with a $7,000 limit, if you contribute $2,000 to a deductible IRA for the year, you may contribute only $5,000 to a Roth IRA for that same year.

How are distributions from a Roth IRA treated for tax purposes?

In order to avoid any federal income and penalty taxes, distributions need to be qualified. To qualify, a distribution may be taken only:

- After the age of 59.5

- After a five-year holding period

- Some exceptions include first-time home purchase up to $10,000, birth or adoption expenses up to $5,000, and higher education expenses

Uncle Sam usually finds a way to tax earnings which means tax advantaged vehicles are few and far between. But Roth IRAs are great solutions for those saving for retirement and want to do so in a tax-efficient manner.

When must I start taking distributions from a Roth IRA?

The tax law’s minimum distribution rules for traditional IRA owners over age 72 (or 70½ for those born before July 1, 1949) don’t apply to Roth IRAs. So, you can keep your money in a Roth IRA as long as you want.

What if I already have a traditional IRA? Am I allowed to switch it over to a Roth IRA?

Federal tax law allows current IRA owners to convert or “rollover” monies from an existing traditional IRA to a Roth IRA. However, any taxable amounts that you transfer from an existing traditional IRA to a Roth IRA must be included in your income for tax purposes.

Remember, traditional IRAs are pre-tax accounts, meaning you haven’t paid any tax yet. Roth IRAs are after-tax accounts, meaning you pay the tax before the contribution is made. There are no income or filing status restrictions on Roth IRA conversions.

Reach out to a financial professional, like the team at Emerj360 if you have questions or are interested in creating a personalized retirement plan.