What Type of Investor Are You?

While there have been many recessions over the last century, the stock market has continued its trajectory higher. That’s not to say specific industries or sectors have come and went (think many technology companies in the late 1990s), but investors with diversified portfolios have prevailed.

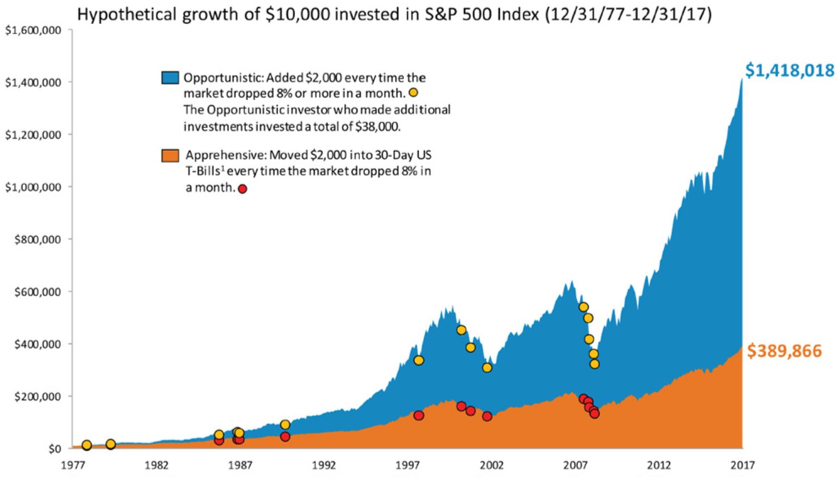

That brings us to two types of investors: opportunistic and apprehensive. Opportunistic has been a common trait amongst successful investors over the last 100 years.

The example below illustrates a hypothetical between an opportunistic and apprehensive investor. The result is very simple: the opportunistic investor who added money when the market drops instead of taking money out when it drops (which is what the apprehensive investor did) has yielded superior outcomes over long periods of times.

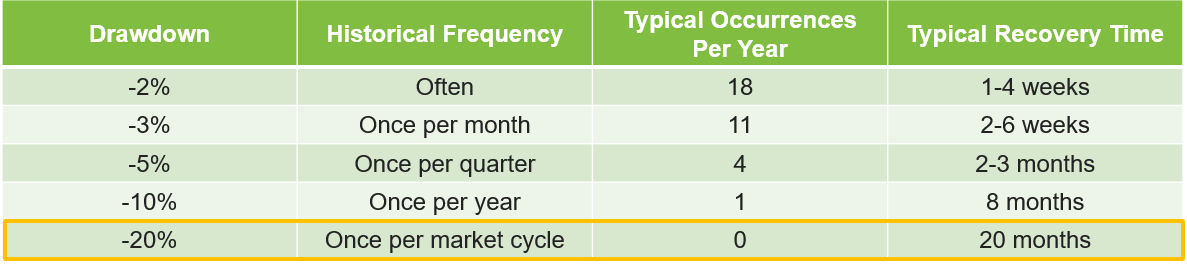

If you don’t believe those opportunities come around very often, look no further than below. Historically speaking, the S&P 500 has dropped 10% once a year.

Drawdowns happen more than investors realize. When they do, will you be the opportunistic or apprehensive investor?