Avoiding Common Investing Errors

Every investor, even experienced ones, makes mistakes. The “can’t lose” investment that may seem like a great opportunity all too often can lose — and lose big. While there is no guaranteed method for avoiding costly mistakes, recognizing common pitfalls can help investors keep their portfolios on track.

1. Concentrations in a Single Stock or Fund

Investors who are overly confident in their ability to pick winners may invest a large portion of their assets in one stock or stock fund. This concentrated “swing for the fences” approach tempts investors with big potential gains. But in reality, this approach simply moves a portfolio far out on the risk scale with potentially devastating losses.

A more sensible approach is to allocate across different asset classes, such as stocks, bonds, and cash. This approach is called diversification. Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. Diversification also limits exposure to any single asset or risk.

Practicing diversification takes advantage of the fact different securities and investment types usually do not move in the same direction at the same time. As some investments fall in value, others may rise or hold steady and help offset the losses. While diversification does not ensure a profit or protect against losses, it is a well-tested approach that can help investors manage their risk exposure, and make the investment journey a lot more comfortable.

2. Trying to Time the Market

Trying to time the market seems easy. Buy and stay invested as stocks are moving higher, then sell and move to cash when the market starts heading south. Then, move out of cash and back into stocks when they renew their climb. Unfortunately, it’s not that simple, and taking this approach is another common error.

Investors who have allocated their assets appropriately through diversification may be better served staying invested through up and down markets. History has shown investors that markets are cyclical, meaning they will move in every direction. History has also shown us that trying to time those cyclical moves can be extremely challenging, and potentially costly to your investments.

The bottom line: staying invested through all types of market conditions can potentially bring investors closer to achieving their long-term investing goals.

3. Taking a Short-Term Perspective

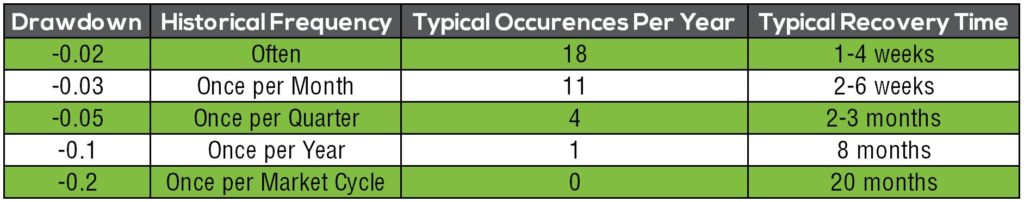

Another common investing error occurs when an investor takes a short-term perspective with money intended for long-term goals. Long-term investors can’t let the day-to-day changes of the stock market or other economic factors force them to make irrational buy or sell decisions. History shows that most market corrections are temporary and healthy, and investors who panic and sell their investments in response may likely be sitting on the sidelines when the market starts moving back up.

Taking a long-term perspective and maintaining an asset allocation that is in line with one’s time frame and tolerance for investment risk remains the optimal way to reach long-term goals. Seeking the input of experienced financial professionals can help investors align their investments with their goals and avoid common investing errors. Connect with out team if you’d like to learn about Emerj360’s investing services.