2024 Tax Guide: Quick Takes for the New Year

View the 2024 income tax brackets, long term-capital gains tax rates and insights on some factors that may impact your tax situation in this guide.

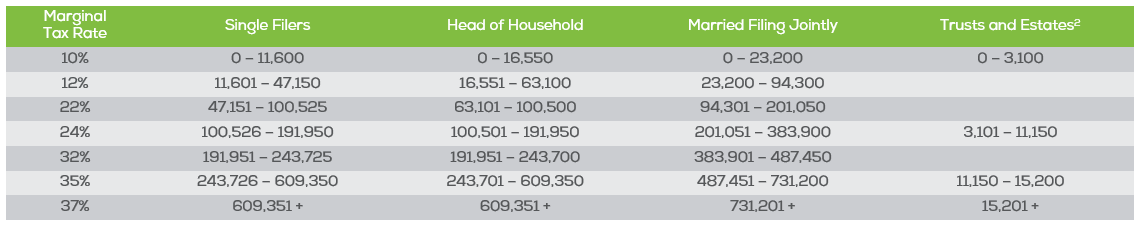

2024 Federal Tax Provisions

2024 Federal Income Tax Brackets for single filers, heads of household, married filing jointly, and Trusts and Estates.

(Click the chart to enlarge it.)

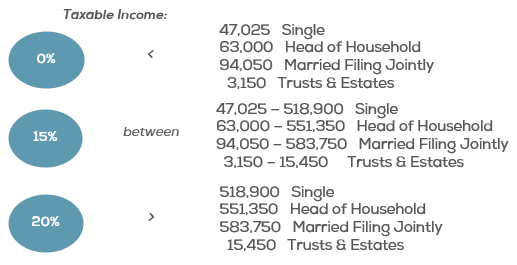

Long-Term Capital Gains Tax Rates

Insights on Tax Strategies and Upcoming Tax Strategy Changes

Charitable “Bunching” Remains Effective

Given the sharp increase in the standard deduction under the Tax Cuts and Jobs Act (TCJA), charitably inclined taxpayers who itemize deductions should review the net tax savings from their charitable giving and should consider whether “bunching” a higher proportion in a single tax year could be beneficial. Utilizing a donor-advised fund or private foundation for this purpose can be an effective strategy.

Tax Cuts and Jobs Act (TCJA) Back in Focus

With the Tax Cuts and Jobs Act (“TCJA”) set to expire Jan 1, 2026, we expect an increased focus on tax legislation both on Capitol Hill and across the airwaves given the upcoming 2024 Election Cycle. From our perspective, 2024 presents a window of opportunity for taxpayers to re-evaluate and adjust their planning strategies with current law, with the possibility of certain tax provisions expiring after 2025.

Additional Opportunities for Gifting

The lifetime gift tax exemption increases in 2024 by $690,000, to a new limit of $13,610,000 per person. Individuals who had previously exhausted their lifetime gifting exemption may now find capacity to remove additional assets from their taxable estate. Keep in mind the much-elevated exemption amount is scheduled to “sunset” at the end of 2025 to a potentially much lower amount, beginning in 2026 (possibly estimated at an inflation-adjusted amount of ~$7 million per person).

1 Source: The Tax Foundation – “2024 Tax Brackets” (November 9, 2023)

2 Source: Forbes – “IRS Announces 2024 Tax Brackets” (November 9, 2023)