For 401(k) Plan Participants, Consistency is Key

Recent research1 from the Employee Benefit Research Institute (EBRI) and the Investment Company Institute (ICI) found that 401(k) plan account balances increased significantly between 2016 and 2020 for participants who made regular and consistent contributions to their plan accounts. The study reinforces just how helpful it is for plan participants to contribute consistently to their plan accounts over time.

The Finding Are Significant

The research examined the 401(k) plan accounts of 3.7 million participants in the EBRI/ICI database who had accounts at the end of each year in the period being studied, identified as “consistent” participants. What the researchers found was significant: that the average account balance of consistent participants rose each year from 2016 to 2020. Impressively, balances increased at a compound annual average growth rate of 19.4% over the period.

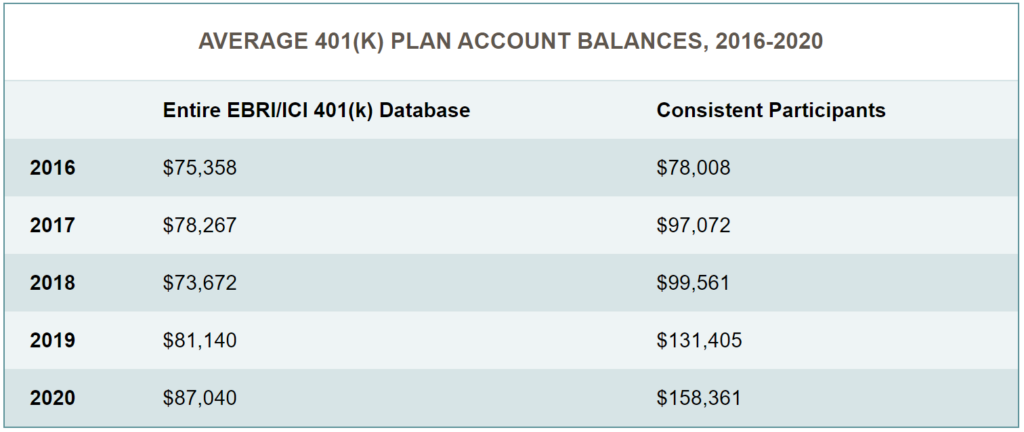

The table below illustrates that the average dollar value of the accounts owned by consistent participants rose from $78,008 at year-end 2016 to $158,361 at year-end 2020. That year-end 2020 plan balance of $158,361 was 82% higher than the $87,040 average account balance of participants in the entire 401(k) database.

Approximately one-fifth (22.2%) of the consistent participants had more than $200,000 in their 401(k) plans at year-end 2020, while 15.8% had between $100,000 and $200,000. In contrast, only 11.4% of participants in the broader database had 401(k) accounts with more than $200,000, and only 9% had account balances of between $100,000 and $200,000.

Distinct Differences Among Age Groups

Younger consistent participants experienced higher percentage growth in their account balances than older consistent participants. For example, the average balance of those in their 20s increased at a compound average growth rate of 57.4% between 2016 and 2020, while the growth rate for those in their 60s was 15.4%. The percent change for participants in their 20s was heavily influenced by the relative size of their contributions to their account balances.

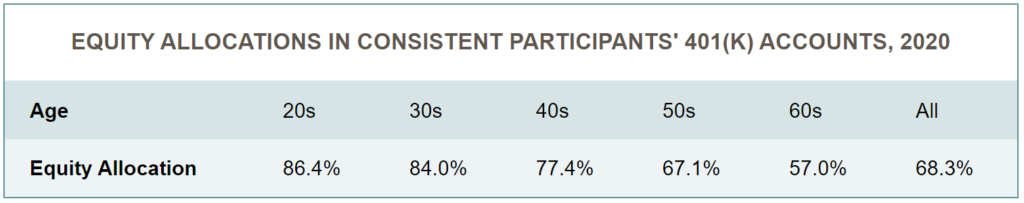

More than two-thirds (68.3%) of the assets of consistent participants were invested in equities. The table below shows that younger participants held a significantly higher percentage of their 401(k) plan assets in equities than older participants did.

The findings are important in that they illustrate that consistent participants have, because of their commitment to saving, the potential to attain their goal of retirement security.

Source:

1] Sarah Holden, Steven Bass, and Craig Copeland, “What Does Consistent Participation in 401(k) Plans Generate? Changes in 401(k) Plan Account Balances, 2016-2020,” ICI Research Perspective 29, no. 2, 2023.