Eight Common Mistakes That Can Jeopardize Your Retirement

According to Charles Schwab, retirement planning is the number one source of financial stress for the majority of Americans.1 Given the potential for retirement to span 20 or more years, it is extremely important to avoid costly mistakes today which could have detrimental costs tomorrow. This article outlines eight common mistakes people make which can have detrimental impacts on retirement.

1. Delaying or Neglecting Savings

Albert Einstein remarked that compound interest is “the eighth wonder of the world.” Capitalize on the power of compound interest by initiating investment savings early and, even better, consistently. Every dollar saved now has the potential to grow significantly by the time you retire. Remember, compound interest works in your favor, so the longer your money remains in your retirement account, the more beneficial it will be in the future.

Consider having your payroll provider automatically invest a percentage of your paycheck each pay period into a 401(k) or IRA; attempt to make sure you are deferring at least enough to take full advantage of employer-matching contributions and, whenever possible, make the maximum allowable annual contributions to retirement accounts.

2. Excessive Spending and Living Beyond Your Means

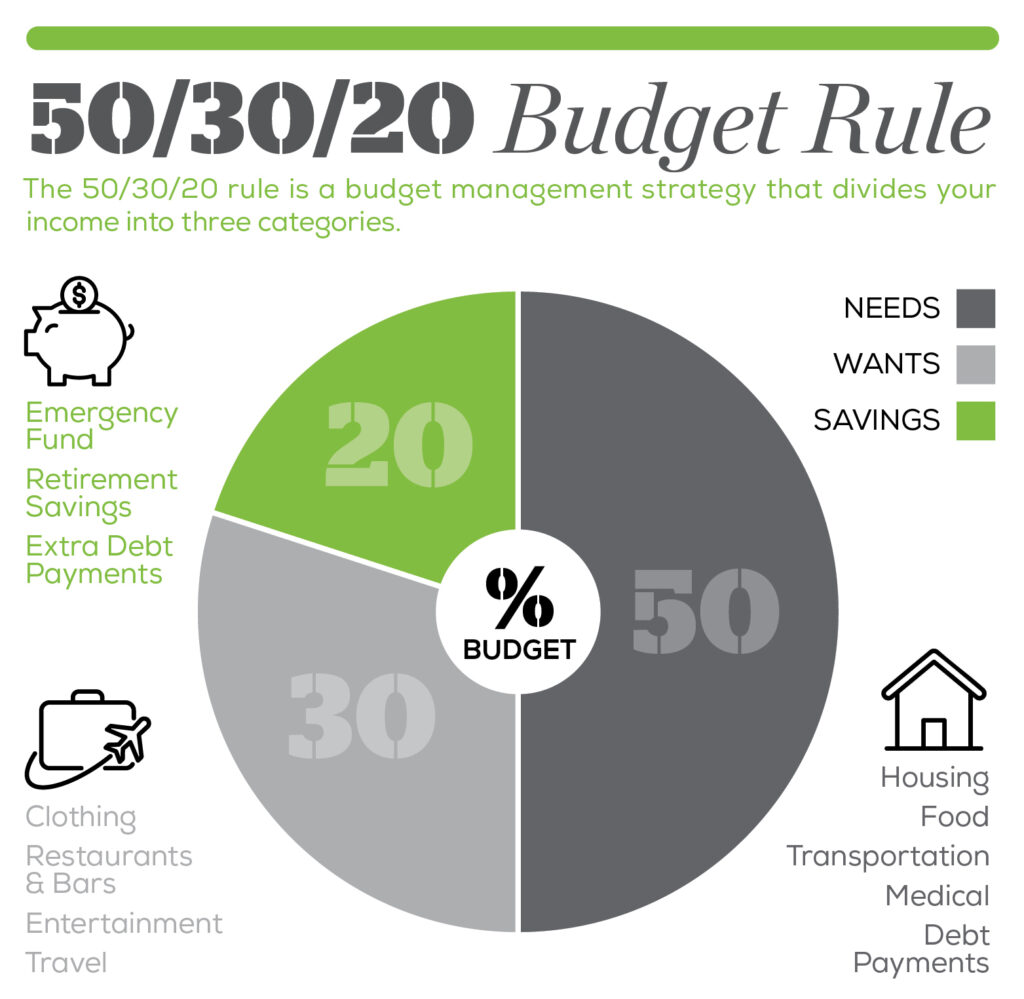

The more you save now, the greater level of comfort you can expect during your retirement. It goes without saying that it is crucially important to avoid overspending. As a general rule of thumb, housing expenses shouldn’t exceed 30% of your monthly gross income.2 However, for some individuals (particularly those living in major metro areas), this may not be a realistic target. In such cases, you should consider the 50/30/20 rule: 50% of your income should go towards bills, groceries and other expenses, 30% should be reserved for discretionary items such as dining out, entertainment, etc. and the remaining 20% should be allocated to saving and investing. By following the 50/30/20 rule, if housing costs exceed 30%, you can adjust within the 50% allocation and then make necessary adjustments to other expenses.

3. Managing Debt Poorly

It is crucial to not only consider the amount of debt you have, but to also pay attention to the interest rates on that debt and its potential to grow over time. Prioritize paying off debt before retirement and avoid driving up debt in the years before retirement. Strive to strike a balance between saving for retirement and gradually paying off your debts within a reasonable timeframe. By finding a way to save for retirement while also managing your debts, you will ultimately reap greater benefits.

4. Underestimating Healthcare Costs

It is very common for people to underestimate healthcare costs in retirement under the assumption that Medicare will pick up the tab. However, a study by Fidelity estimates a 65 year old couple will need $315,000 to cover medical expenses in retirement (excluding long-term care).3 A thoughtfully constructed retirement plan factors in healthcare expenses as part of a longer-term plan.

5. Retiring Too Early

While retiring early might sound enticing, it is important to consider whether you have sufficient assets set aside for retirement. Retiring too early can put undue stress on a portfolio to provide for living expenses over a longer retirement period. It may be easier to continue working and saving rather than having the unfortunate realization that you need to re-enter the workforce due to insufficient retirement assets.

6. Cashing Out Retirement Accounts Early

In addition to giving up future growth, individuals who take early distributions from a traditional retirement account (generally, before age 59½, with some exceptions) will have such distributions taxed as ordinary income plus a 10% tax penalty.4 Needing early distributions from a retirement account to span the retirement years could be a sign to continue to work and save.

7. Failing to Diversify Investments

Diversification involves allocating investments across various asset classes (bonds, stocks, real assets, etc.) and geographical regions, with the goal of reducing a portfolio’s risk. Failure to diversify investment assets could put a portfolio at additional risk, particularly for those nearing retirement who will need to begin drawing upon those retirement savings. Individuals should consult with their financial advisor to determine a prudently diversified investment strategy which aligns with goals, risk tolerance and time horizon.

8. Neglecting to Review and Adjust a Retirement Plan

A retirement plan can change considerably over the years as life circumstances change. As such, it is important to regularly assess your retirement plan to see if you are on track for a happy and fulfilling retirement. This process should incorporate what reserves you have set aside for medical and caregiving expenses as well as an analysis of an optimal time to collect Social Security retirement benefits.

By addressing these questions and adjusting your retirement plan accordingly, and spending and saving within your financial means, you are proactively preparing yourself to be well-equipped for a secure retirement. For more information, including how you can seek to avoid these common mistakes in your personal journey toward retirement, book a meeting with the professionals at Emerj360.

[1] Top 4 Retirement Worries—And How To Handle Them – Forbes Advisor July 15, 2022

[2] How much of your income you should spend on housing (cnbc.com) July 15 2021

[3] How to Plan for Medical Expenses in Retirement (investopedia.com) December 30, 2022

[4] Checklist: Exceptions to the 10% Penalty on Pre-Age 59½ Retirement Plan Distributions | Morningstar September 2, 2022