Could You Live on $21,924 a Year?

It doesn’t seem like a lot, but it is the average annual Social Security benefit for all retired workers in 2023. Could you get by on this amount?

Sure, some expenses could be lower once you retire — your mortgage may be paid off, your children may be financially independent, and you won’t have work-related expenses. However, other expenses, such as new hobbies or additional travel, may take their place. And you should anticipate that certain expenses, such as healthcare, will be more costly as you age. Also, don’t forget the potential for inflation and its impact on the cost of food, utilities, and other goods and services.

Social Security Is Only a Safety Net

The reality is that it may not be wise to count only on Social Security. If you want a better quality of life in retirement, you have to take responsibility now and focus on building your own retirement savings. You can use the savings you accumulate while you are working to help make up the difference between what Social Security may provide and what you’ll need to live comfortably when you retire.

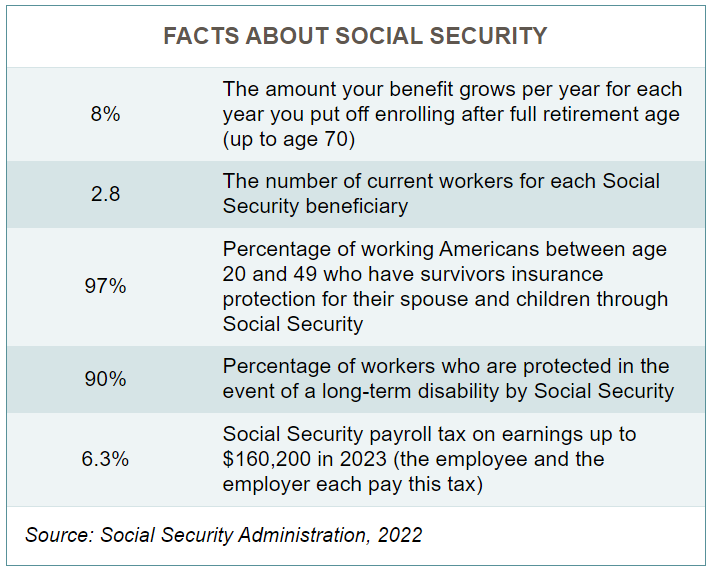

The chart below shares some facts about social security.

Harness the Power of Compounding

Contributing to your employer-provided retirement plan is an important first step, but it can also be important to keep increasing the amount you contribute over time. The more you put into your plan, the greater your potential retirement income. Long-term compounding may turn even a small contribution increase into a higher plan balance at retirement.

View our blog “Key Considerations for Planning Retirement Income” for some additional insights and tips.