A Roadmap to Early Retirement

Key considerations for achieving a worry-free workforce exit.

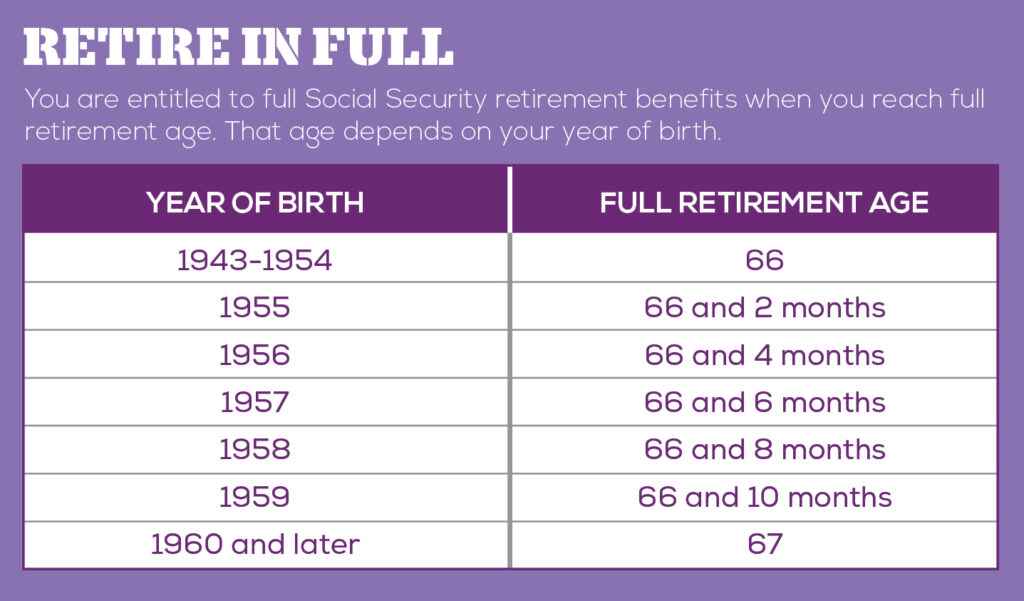

For many years, age 65 served as the benchmark for retirement. That’s largely because it’s the age that was considered “fully retired” based on Social Security parameters for decades — the age you could access benefits penalty-free. Today, “fully retired” is 67 (for anyone born in 1960 or later), but the popular view of retirement age is moving in the other direction.

A recent Harris Poll found that among working Americans who plan to retire, the average expected retirement age is 57. Some are working toward significantly younger retirement ages. It’s a trend that started in earnest during the COVID-19 pandemic, when changing life outlooks and priorities led to the Great Resignation, with millions of people retiring earlier than planned. Many of those sentiments stuck, with more Americans reassessing priorities, from time spent with family to travel goals. If early retirement is something you hope to achieve, planning ahead is essential. Leaving the workforce early creates a range of challenges, most notably making sure you have the savings to support your lifestyle and achieve your goals. The six steps outlined below will help you overcome these core challenges and begin your journey to an early retirement with confidence.

Determine your goals.

An essential consideration often overlooked is: what are you going to do with your time? Do you have travel plans? Are you looking to purchase a second home? What is your day-today lifestyle?

It’s important to think about how you’re going to fill the 40 hours per week you currently spend working. It’s common for retirees to go through a host of different stages, from jubilant at first to feeling a lack of purpose later.

Start a conversation with your loved ones and friends. Think about what you want to do, how you will stay

engaged, and the core reasons you want to retire early.

Start saving aggressively — early.

We recommend that people looking to retire at age 65 save at least 15% of their income. If you want to retire earlier, you’ll need to save more or start saving earlier.

How much you need saved depends on many factors. There’s no right answer, because everyone has different goals. It’s important not to compare retirement dates with others. People sometimes express a desire to retire because they see their friends doing the same. However, it’s important to remember that everyone’s financial situation and goals are unique.

Making the decision to retire based on your own plan is really important, but one universal need is saving as much as possible. Max out 401(k) contributions, IRAs, and contribute to taxable accounts. As soon as you know you want to retire early, which typically occurs in your 40s and 50s, start maxing out those accounts if you’re able to.

Look at your discretionary and non-discretionary expenses.

When you’re looking at your expenses, it’s important to distinguish between discretionary and non-discretionary expenses. Non-discretionary expenses are those that are essential and must be

paid, such as:

- Mortgage payments and other housing expenses, utilities and taxes

- Vehicle payments and maintenance

- costs

- Healthcare

- Minimum debt payments

- Groceries

These non-discretionary expenses are typically fixed, recurring, and they need to be accounted for in your retirement planning. Mortgage debt is typically not bad debt, especially given the low interest rate environment of recent years. It may not be necessary to pay off your mortgage prior to retirement but consider what your monthly expenses will be if you have to carry that mortgage payment further into retirement.

Most people want to pay off their debt before retirement, so their monthly expenses are lower, allowing them to have more financial freedom for other goals in retirement. Understanding what your expenses are today and what expenses may last into retirement will be important when planning for early retirement.

Also consider discretionary expenses, which are expenses you have more control over and can adjust as needed. These include:

- Travel and entertainment

- Hobbies and leisure activities

- Charitable giving

- Helping family members (for example, helping with the purchase of a first home or college funding for grandchildren)

When planning for retirement, it’s important to consider how your discretionary spending may change. For instance, you may want to travel more in the early years of retirement, but then scale back later. By categorizing your expenses as either discretionary or non-discretionary, you can better understand your financial obligations and make informed decisions about your retirement planning. Establishing a financial plan will help you determine if you’ll have sufficient resources to meet your goals and needs in early retirement.

Bridge the gap between retirement and Medicare.

One of the most important considerations for early retirement is that Medicare doesn’t start until age 65. Healthcare can be a large out-of-pocket cost if you retire before 65 and have to pay for private insurance. For some households, that’s the determining factor in whether they can retire early. We know today that healthcare costs are increasing at a rate greater than other goods and services, but it is a necessity for retirement.

When making decisions about healthcare, consider deductibles, co-pays, out-of-pocket costs, prescriptions for pre-existing conditions, and any major health issues. Understand the options from your employer or the insurance company you are working with, get to know how the marketplace works, and

determine what your income is going to look like in retirement. Have you accumulated other assets or resources that you can draw on to bridge the gap from retirement to Medicare?

It’s important to make an honest assessment of your healthcare needs and to work with a good insurance

provider that can help you meet them. Some people plan as if they’re never going to have a big health event and then something happens and they’re not fully insured or prepared.

A lot of people have questions about whether they should work longer and keep their workplace health insurance versus going on Medicare — it’s a gray area. COBRA coverage can be cost effective, depending on your employer, but most individuals we work with end up going to the marketplace or private insurance and buying a policy out of their own pocket.

Another consideration is building up non-qualified savings to help cover your insurance costs. Non-qualified savings can help reduce your taxable income when applying for health insurance. They can also help you avoid early withdrawal penalties, should you retire before age 59 1/2. Taking advantage of a

health savings account (HSA) is another good idea if you are planning to pay for healthcare prior to 65.

Decide when to take Social Security.

Social Security is something you really want to think carefully about before enrolling and drawing on your benefit.

You can start drawing Social Security at age 62, but full retirement age — 67 if you were born in 1960 or later — is when you receive 100% of your benefits. Understanding the costs associated with retiring early and deciding to draw Social Security early may lead to a permanent reduction in your lifetime benefit. It could impact your spouse’s benefit as well.

Health can be another factor when deciding to draw Social Security. If your health is poor, maybe you start drawing Social Security sooner versus waiting for full retirement age or later. If you delay taking Social Security beyond your full retirement age, it grows at roughly 7–8% per year.

When considering drawing Social Security, you should evaluate the assets you have available. Do you have non-qualified assets or taxable assets? Do you have ROTH or after-tax assets? What other retirement income do you have, such as part-time work or pension income? When working with a financial

planner at Trust Point, we weigh all of these factors to help you determine the optimal time to start drawing your Social Security benefits.

Work with an expert.

The critical decisions needed to ensure a confident early retirement shouldn’t be made alone. If you’re dreaming of an early retirement, the team at Emerj360 can help make that dream a reality. Our team has the expertise, experience, and depth of resources to build and execute a custom-tailored financial plan to live out your goals. We take the stress out of planning, answer the hard questions that matter most, and guide you every step of the way, so you can retire how you want, when you want.