How to Create a Budget for Your Financial Plan

When it comes to following your financial plan, your budget serves as a roadmap for your spending each month. Building a budget that is organized, comprehensive and easy to follow is an important step to growing your wealth and savings. And while following a budget may seem like a tedious task, it is actually simpler than you might think.

Here are the steps you can take to create a budget for your financial plan.

Evaluate Your Current Standing

Before establishing a budget, you should set both long-term and short-term goals that will help guide how you will spend your money. For example, if your goal is to retire early or save money for your child’s college tuition, that might mean you are budgeting more money to your savings.

To build your budget, start by calculating your net income — or your monthly paycheck after taxes and your employer-sponsored retirement contributions. From there, you should list out all your fixed and variable expenses to estimate how much you are spending each month. Your fixed costs are the expenses that will generally stay the same month-to-month, like your mortgage or rent payments, while your variable expenses can include your grocery bills or utility payments. Once you have identified how much money you have to work with and where you are spending your money, you can go on to create your budget.

The 50/30/20 Rule

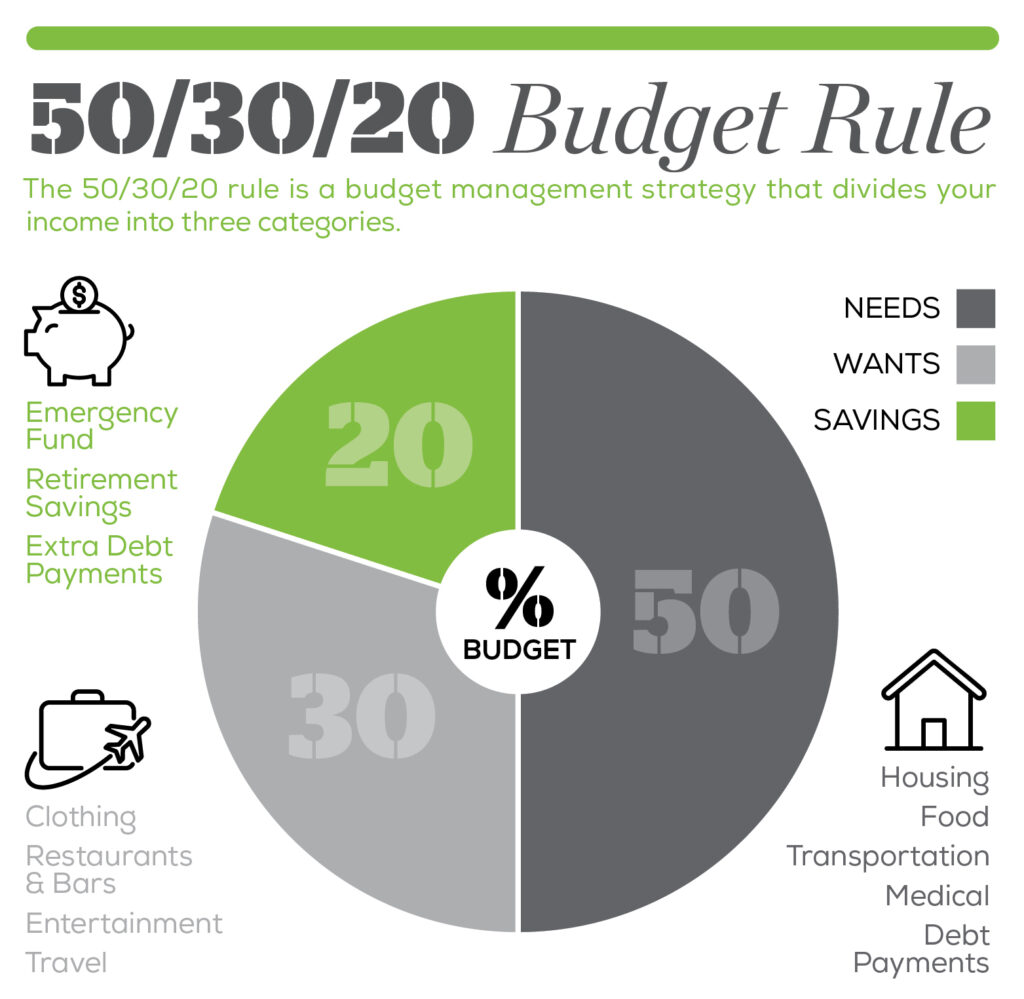

While there are several ways to establish a budget, Emerj360 recommends following the 50/30/20 rule. Using this strategy will help you easily track your spending, and is perfect for those who want to build a budget, but don’t know where to start.

When following the 50/30/20 rule, 50% of your net income should be spent on your “needs,” including your living expenses, health insurance costs, and your groceries.

The next 30% of your income can be spent on your “wants” — from your streaming service subscriptions to vacation funds to the money you spend on new clothes or other material items.

The last 20% of your budget should be devoted to your savings, like your retirement or your child’s college savings. There are several caveats you should consider when following the 50/30/20 rule. For example, only 20% or less of your net income should go toward your consumer debt, such as credit card debt or auto loan debt. Additionally, no more than 28% of your gross income should be used for your housing debt.

Save For Emergencies

When crafting your budget, it’s essential to set aside money that can be spent in an emergency. Financial experts agree that you should have about three to six months of living expenses saved in liquid cash. If you are at a higher risk of being laid off or are in retirement, consider saving even more to this fund. Ultimately, having an emergency fund can give you the piece of mind that you’re prepared for any of life’s unexpected changes.

Adjust Your Budget As Necessary

Depending on your lifestyle and your current financial standing, you may need to adjust your budget and financial plan. As you approach retirement, for example, you might decrease what you are spending on your “wants” and increase the percentage of your income that you are saving. You should re-evaluate your budget at least once a year and when you go through a major life change such as a new job, marriage, or having a child. Try using a spreadsheet to keep your spending and expenses organized, and work with a financial professional when the time comes to alter your budget.

Budget With a Professional

If you are looking to track your spending and plan your budget, our financial professionals at Emerj360 can help. Our team can help you evaluate your spending and work with you to create a sustainable budget that helps you reach your financial goals.