When to Start Receiving Social Security

When to start receiving Social Security retirement benefits is an important decision, especially when you consider retirement could span 20 years or more. Many individuals do not maximize their social security benefits but instead opt to collect them earlier at a reduced rate.

One recent study from United Income found that just 4 percent of retirees start their Social Security benefits at the optimal time.

So, how should retirees assess when to collect benefits? It’s largely an individual decision. Here are some key considerations for making the best decision for you.

Eligibility & Benefits

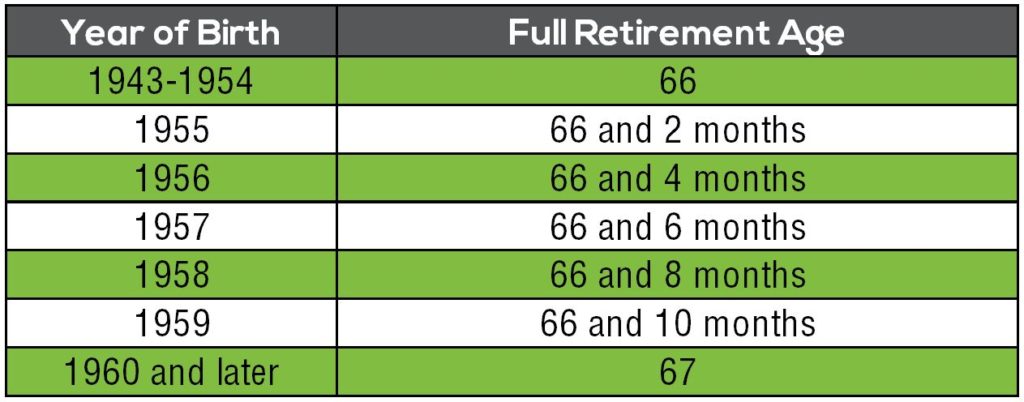

Social Security retirement benefits are generally available to individuals with at least 40 earned credits, which is the equivalent of 10 years of employment. Based on an individual’s earnings record, the Social Security Administration (SSA) calculates a “primary insurance amount” (PIA) which reflects the retirement benefits available at full retirement age (FRA).

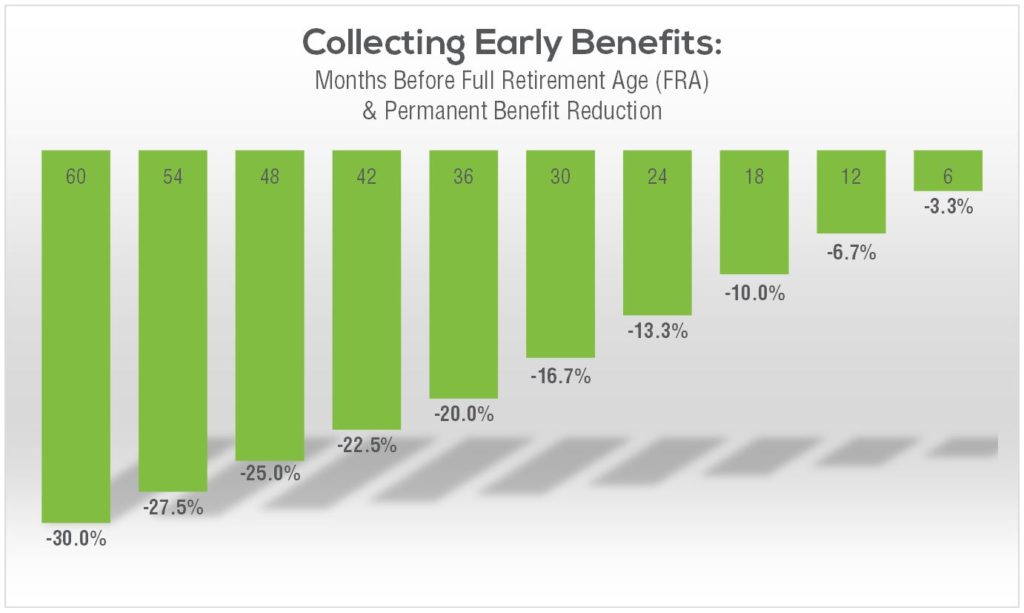

Individuals can choose to collect retirement benefits as early as age 62 or as late as age 70. For those who elect to start benefits before full retirement age, a permanent reduction applies depending on how early benefits are collected, which is shown in the chart below.

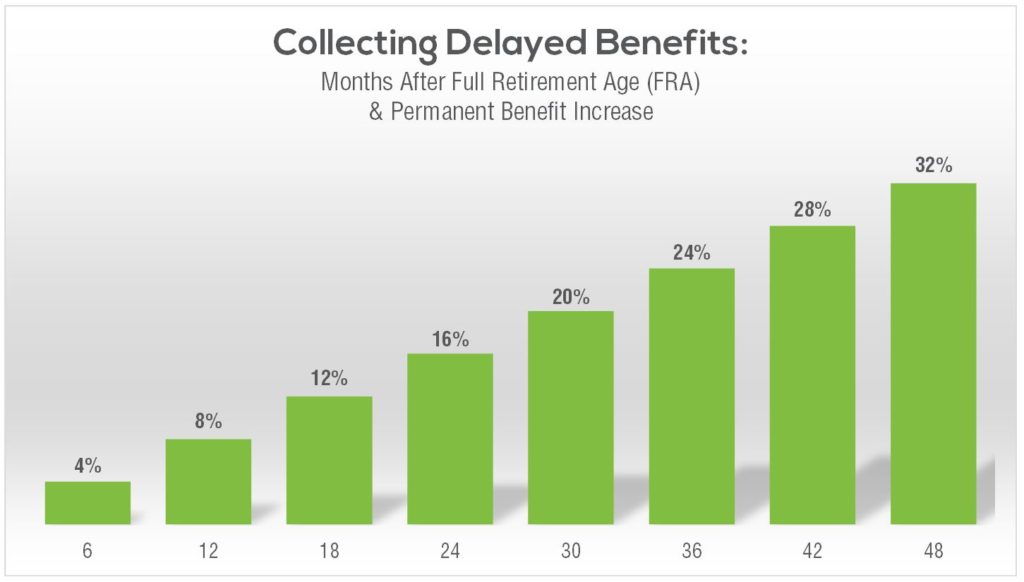

For individuals who wait to collect Social Security retirement benefits, a delayed retirement credit applies, as shown in the percentages in the chart below. For individuals born in 1943 or later, the delayed retirement credit works out to an 8% annual increase up to age 70. So, for an individual with a Full Retirement Age of age 67, the FRA monthly benefit could be permanently increased by 24 percent if they waited until age 70 to collect.

Considerations for When to Collect Social Security Benefits

We generally recommend waiting to collect benefits, but there could be many reasons for a different approach.

Life Expectancy

According to the Social Security Administration, a 65-year-old today has a life expectancy of approximately 20 years. Current health and family health history are critical factors when evaluating an appropriate start date for benefits.

Income Needs

Retirees with sufficient retirement savings may have the resources to delay benefits several years to permanently increase monthly benefits. This, of course, doesn’t apply to everyone and we understand you might need to take your benefits sooner rather than later.

Spousal Benefits

Couples that are similar in age and with similar benefits may have greater planning opportunities, with the ability to collect one benefit while postponing the other to accrue delayed retirement credits.

Current Employment

Individuals that are still working, yet choosing to collect benefits before full retirement age, may be subject to benefit reductions. Prior to the year of full retirement age, $1 of benefits is deducted for every $2 earned above the annual earnings limit ($22,320 for 2024).

In the year of full retirement age, benefits are reduced by $1 for every $3 above the earnings limit ($59,520 in for year of FRA in 2024). Benefit reductions due to the earnings limit are only temporary, as the monthly benefit will be recalculated upon full retirement age to give credit for previously withheld payments.

There are many considerations when deciding to initiate social security. Each situation is different, but we are here to help guide in the decision making process that helps maximizes your benefits. Schedule a conversation if you’d like to learn more.

Additional Social Security Resources:

- Watch On-Demand Webinar Recording: Social Security Benefits

- Request our Social Security Guides

- Watch our Tips Tuesday video: Maximize Your Social Security Benefits