Retirement Ready at Every Age: Key Considerations for All Ages

For some, retirement is a far-off dream; for others, it is urgently approaching. No matter your age, the most important aspects of planning for retirement are education, preparation, and action.

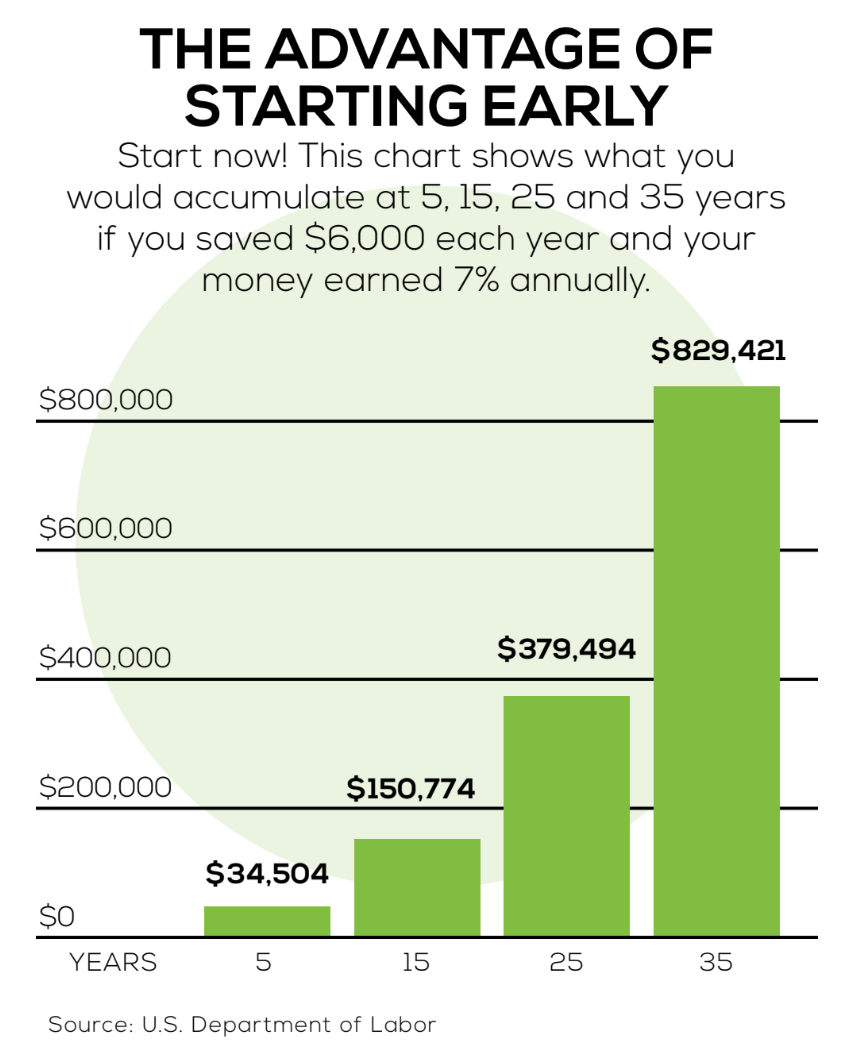

Starting early with small saving efforts can make a substantial difference in the long run, and strategic planning as you near retirement ensures that your golden years will be comfortable. No financial plan is one-size-fits-all, but there are some important general guidelines to follow that are beneficial in the process of retirement planning.

Steady and consistent goals throughout your working years are foundational to creating the lifestyle you envision during retirement. We’ve outlined some age-range retirement guidelines to help you navigate and prepare as you advance through your working years. Although these goals are separated by age group, they build upon each other and should be carried forward as a best financial practice through all ages.

Age 25: Start Saving and Get Curious

In your 20s, retirement seems so distant that it might be hard to clearly see how small financial actions will affect you down the road. This is the best time to learn personal finance basics, like budgeting, paying down debt and saving. It’s also a great time to ask questions and develop a working understanding of your company’s retirement account.

Here’s what you can do at 25 to start getting retirement ready:

- Create a budget, and stick to it. Use it to minimize discretionary spending and to help start building up your personal savings account.

- Start getting serious about paying down any debts (student loans, auto loans, credit card debt) you might have.

- Enroll in your company’s 401(k) or similar retirement option. If your company doesn’t offer one, open an IRA and set up regular contributions. Any amount you can set aside towards retirement at this age will make a noticeable difference in the long run.

Age 35: Maximize

Your 30s often mean a more stable, reliable income. During this time, you might be able to pay off significant personal debts like student or auto loans, or you might benefit from a dual income. Both situations create some financial flexibility. Here’s what you can do to build on the work you started in your 20s.

- Max out your company’s match. If you only contributed a few spare dollars to your retirement during your 20s, now is the time to optimize your savings. Take advantage of that opportunity for additional savings by determining the amount you need to set aside to meet your company match.

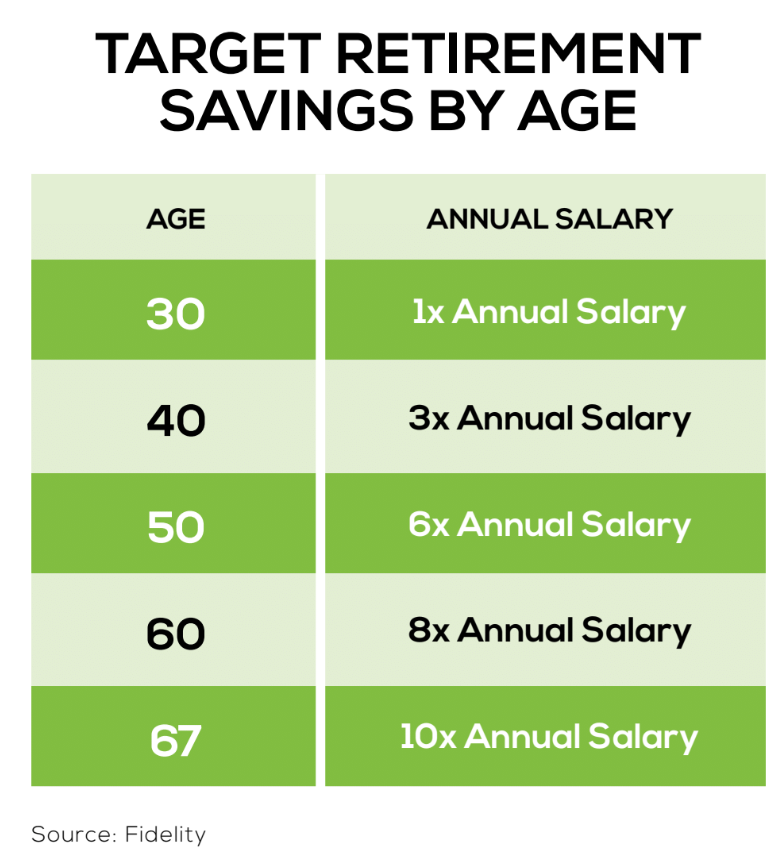

- Assess your account and set goals. Review the balance in your retirement account. You should have approximately1.5x-2x your salary saved by this age. If you don’t, make a plan to get there by adjusting your budget to prioritize your retirement contributions.

- Start a practice of reviewing your retirement account regularly. Watching your savings grow is extremely motivating and helps to contextualize the importance of setting money aside for yourself later.

Age 45: Clarify Your Needs

Now is the time to get specific about retirement income, taxes, and cost of living. In your 40s, you’ll have a better understanding of lifestyle costs and what needs you want to prepare for when you retire. This is the time to look at the big picture of your finances and focus on what you can do now to get you where you want to be when you retire.

- Learn about all forms of income you might have coming your way during retirement, such as a pension or Social Security. These help to refine your retirement savings goals and assess whether your current retirement accounts are on target.

- Factor taxes into your retirement income. Depending on your retirement plan, the money in your account may be taxed at your regular income tax rate upon withdrawal, meaning not every dollar in your account is yours. Adjust your monthly contributions if the actual amount of money after taxes is less than you want or need.

- Put a discerning eye to your mortgage. Could you refinance for a lower interest rate? Could you make a plan to pay it off ? Living mortgage-free in retirement, or nearing retirement, means a lot more financial freedom. This is the perfect time to start making that happen.

Age 55: Boost Your Savings Potential

Once you’re over 50, you can make larger contributions to your retirement accounts. This is the time to get serious and strategic about expanding your savings.

- Max out catch-up contributions to pad your retirement account. In 2024, anyone 50 and over can add an additional $7,500 to most retirement plans, such as a 401(k)or a 403(b). Similarly, you can save an additional $1,000 to your IRA (Traditional or Roth) annually. Although intended to help people who got a late start on retirement savings, anyone in this age group can benefit from this opportunity.

- Consider adding an IRA (Traditional or Roth) to your retirement savings if you feel you need or want addition-al income sources. Speak with your Emerj360 financial professional if this is something you’ll need, and if so, which option is best for you.

- Work with an Emerj360 financial professional to balance your portfolio to reflect your age, tolerance for risk, and investment objectives.

Age 60: Monitor and Sit Tight

Retirement age is approaching, the main goal is to be patient and smart with your funds.

- Take the time to understand exactly how your retirement savings will become your retirement income. Review your portfolio with your Emerj360 financial professional to see if anything should be adjusted. By this age, you should assess your portfolio annually, if not more frequently.

- Leave your money alone, if possible. Once you reach age 73, you have to take required minimum distributions (RMDs) from your retirement accounts. The longer you can let your savings mature to reach their greatest potential, the better off you’ll be.

- Wait until full retirement age (66 if you were born between1943 and 1954) before taking Social Security to maximize your benefits.

Retirement planning is a marathon, not a sprint. Intentionally saving and communicating with our experts at Emerj360 when needed will help you build the life you want during retirement. After a lifetime of working hard and being smart about money, a relaxing retirement is well deserved.