401(k) Decision #1: How Much to Save?

Employer-based retirement plans provide a powerful mechanism for W-2 employees to reduce their tax liability and save for retirement. But, far too often people do not take advantage of this important benefit.

The reasons for not participating or under-participating are varied, but many lose out because they imagine using a 401(k) to be a difficult and complex process. And, based on this assessment, decide it is not worth it and not for them. Others believe there is no benefit to long-term investment. These perceptions are understandable, but are demonstrably incorrect and harmful. Utilizing a 401(k) is generally straightforward and impactful. Moreover, it generally only requires four decisions:

- Decision #1: How Much to Save?

- Decision #2: Which Contribution Option is Right?

- Decision #3: How to Invest?

- Decision #4: Who Will Be the Beneficiary?

This article is the first in a series and focuses on Decision #1. Find links to the additional articles using the links above.

The Maximums

As a starting point, it is important to understand that there are limits on how much employees can contribute from their pay to a 401(k) plan.

In 2024, essentially because of inflation, the limits will increase significantly. Plan participants under age fifty will be able to contribute a maximum of $23,000. Plan participants age fifty or older will also entitled to contribute a “catch-up” contribution of $7,500; for a total limit of $30,500.

These limits are per person, not per plan. So if someone works for more than one organization during the year, and contributes to more than one 401(k) plan, then that person will need to conform to these limits across all of their plans.

How Much Is Needed

If contributing the maximum is possible, it is always recommended. The tax benefits are significant and it is a very rare person who reaches retirement and decides they saved too much. But, if contributing the maximum is not possible, the next issue to consider in determining how much to save is how much someone will need in retirement.

Generally speaking, most retirement planners agree that 70-85% of annual household income when working is required in retirement. That generally means someone will need roughly eight to ten times their household income saved to replace enough of their income to retire. This estimate is rough and, among other things, is based on the fact that there will be at least some expenses that will be eliminated in retirement. For example, the need to save for retirement will no longer exist; and other expenses may no longer exist, e.g., mortgage expenses, commuting expenses, work clothing expenses, etc.

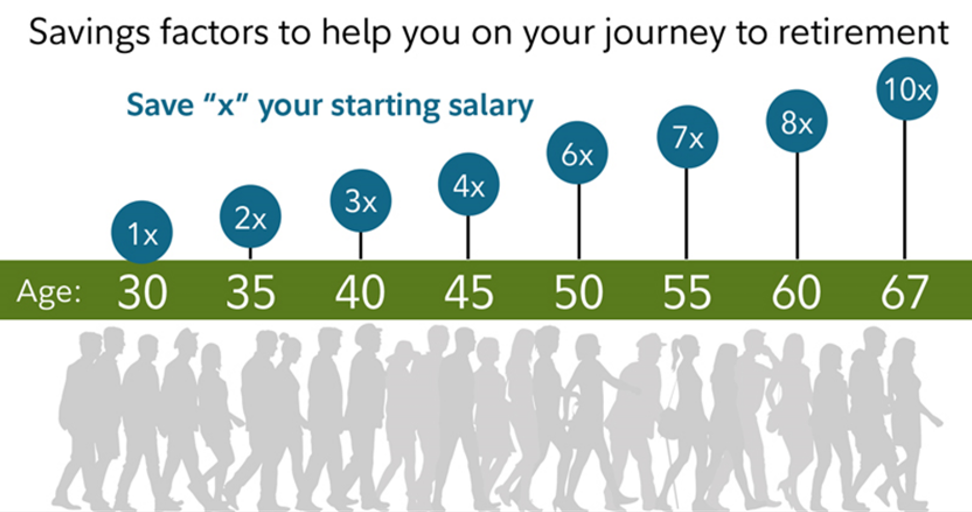

Many retirement planners also recommend having checkpoints along the way to reaching the eight to ten times household income savings goal. For example, at age thirty, many retirement planners recommend having one times household income saved; at age forty total savings should have increased to three times household income; and at age fifty total savings should have increased again to six times household income.

Of course, these are general rules. For one thing, household income will likely change over time, particularly if someone is near the beginning of their career or has made a career change. For another, individual lifestyles may require more or less expense in retirement. Thus, as retirement approaches, consulting with a trusted and knowledgeable advisor is always a good idea. But the possibility of more complexity or analysis down the road should not keep employees from participating. Indeed, the general rule of having eight to ten times household income is useful because it keeps it simple and provides a good sense of what is needed so that employees can get started in their 401 (k) sooner, rather than later.

The Benefits of Acting Now and Increasing Over Time

Acting now is important and makes an appreciable difference. The benefits of a 401(k) accumulate over time and generally speaking the longer someone is invested, the better they can do. Moreover, how soon someone starts contributing to a 401 (k) is generally something within their control, unlike the sometimes unpredictable, short-term fluctuations in the equity and fixed income markets.

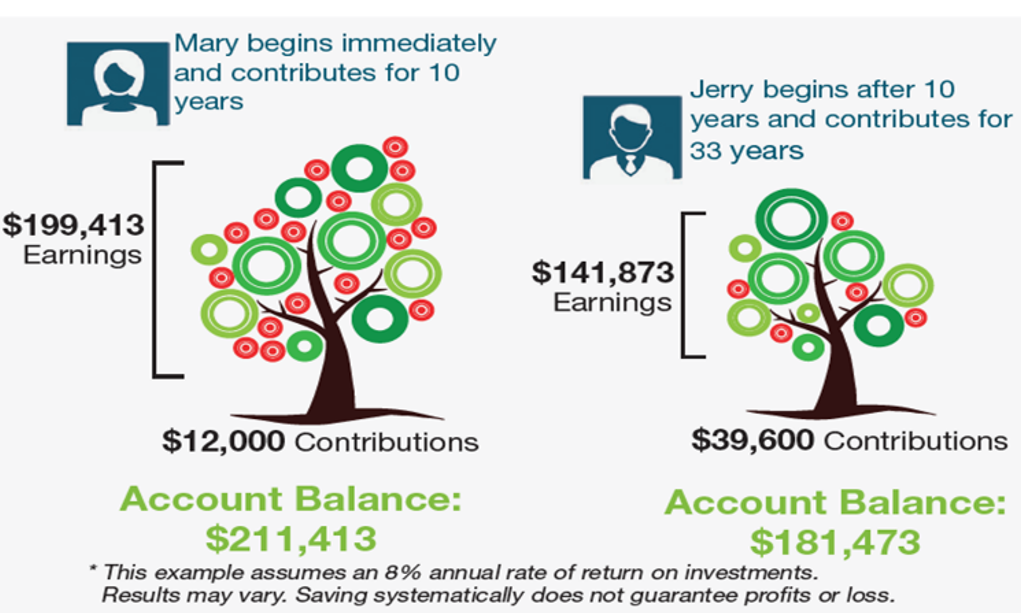

The benefits of acting now are best demonstrated by illustration.

In this illustration, Mary starts investing via her 401 (k) as soon as she starts working. She contributes a modest amount that she can afford over the course of ten years: $12,000 total or $1,200 per year or $100 a month. After ten years she stops investing. For whatever reason, life happens and she needs those funds to pay for it. Despite that, and despite having invested only a total of $12,000, at the end of her working life, she will amass $211,413 in contributions and projected returns.

Jerry puts off investing via his company’s 401 (k). For whatever reason, he waits ten years after he starts working before he starts contributing. He invests a total of $39,600 over the remaining course of his career. Again, that’s $1,200 per year or $100 per month. But for more than three times as long as Mary.

The effect of Jerry’s ten-year delay is considerable. Because he started later, and his contributions were invested for less time, his savings at the end of his working life are much less than Mary’s savings at the end of her working life. Despite the fact that he invested much more.

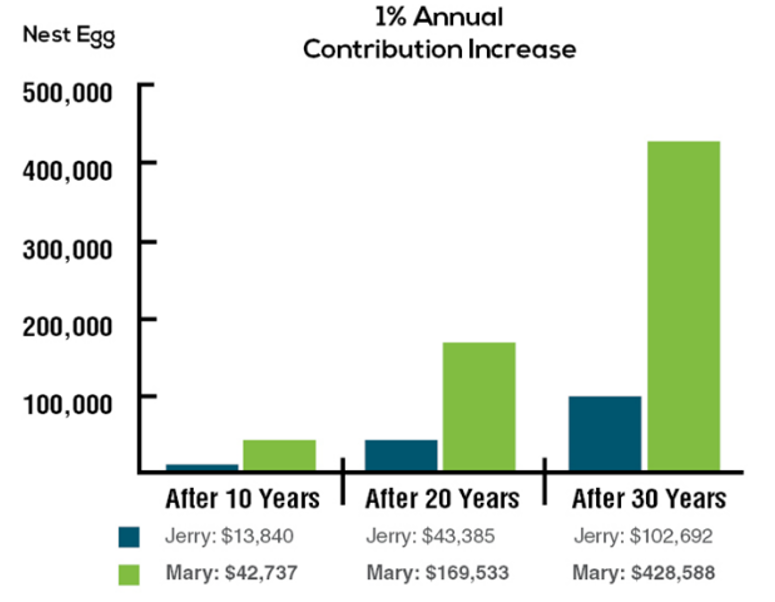

Similarly, over time, small increases to the amount contributed to a 401 (k) can make a big difference.

Again, this is best understood by comparison and illustration.

Here, Mary and Jerry earn the same annual salary and start contributing at the same time. They both start by contributing two percent of their annual salary. Over their careers they move up the ladder together and get the same raises.

The only difference is Mary increases her 401 (k) contributions by one percent every year until her contribution rate reaches ten percent of her salary. Jerry never increases from his original two percent contribution rate.

As time progresses, a meaningful difference develops. The difference is most pronounced after thirty years. But it is also significant after just ten years. Here, after thirty years Mary has $428,588 in her account. Jerry has much less—only $102,692.

Many people are concerned about how contributing at all, much less increasing their contributions over time, will affect their day-to-day economics. That is understandable.

In that frequent situation, the recommendation is generally to start with a contribution level that an employee is entirely comfortable with and to subsequently increase. This is recommended – and not starting high and potentially reducing the contribution – because of behavioral finance studies that demonstrate that if someone starts by contributing too much – and feels too much day-to-day financial squeeze and financial pain as result – then they quit contributing altogether, instead of simply reducing their contribution rate. However, increasing from an initial, comfortable contribution rate does not lead to similar instances of contribution termination. Of course, the key is to be sure to increase.

Finding Ways to Increase Savings

There are many ways to find the money to save in a 401(k) plan. And finding them, and directing the accretive savings into a 401(k) plan, can make the difference between a comfortable retirement and some difficult choices down the road.

Of course, the idea is not to give up on all of the little things that make life wonderful. But, a thoughtful, intentional approach to spending – in which some time is taken to consider purchasing and spending behavior – can allow for savings without much impact on overall happiness. Moreover, even small amounts of money, invested over a long time horizon, can accumulate to significant savings in retirement.

Final Thoughts

In general, early, significant, and sustained participation in a 401(k) plan is a powerful way for a W-2 employee to obtain tax benefits and save for retirement. It can make a real difference in quality of life in retirement and this benefit should be maximized as much as possible.

With all of that in mind, consulting with a trusted and knowledgeable financial professional is always a good idea. But the possibility of some more complexity or analysis in the future should not keep employees from getting involved, participating, and contributing as soon as possible.

Reach out to our team if you have questions about an employer-based 401(k) plan.